Building Your Future Through Smarter Real Estate Investments

Our Story

Deerfield Holdings was founded on the belief that real estate investment should be accessible and profitable for a wider range of investors. We saw the potential in well-managed apartment communities to generate consistent income and long-term wealth. Our team brings together experience in real estate acquisition, finance, property management, and investor relations.

Our Mission

To access to high-quality apartment investments, providing our partners with a transparent, efficient, and profitable avenue for wealth creation.

Our Vision

To be the trusted leader in debt-equity financed apartment acquisitions, recognized for our integrity, expertise, and commitment to investor success.

Our Values

Integrity: Honesty and transparency in all our dealings.

Excellence: Meticulous execution and continuous improvement.

Partnership: Collaborating with our investors for mutual success.

Innovation: Utilizing cutting-edge strategies and technology.

Accountability: Taking ownership of our commitments.

Meet the Team

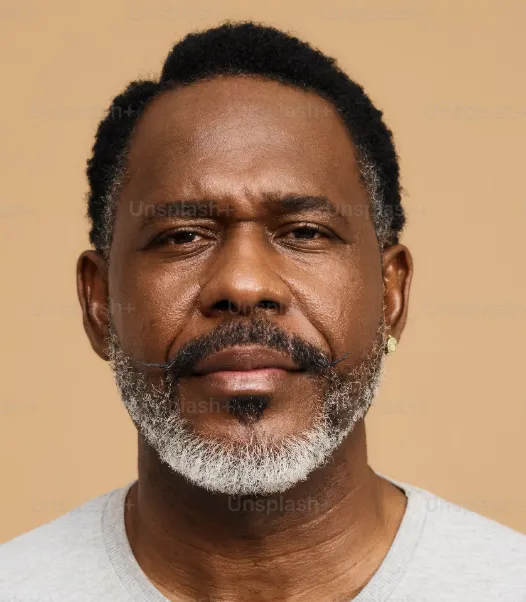

JOHN STORY

CEO, DIRECTOR

Deerfield Holdings was founded on the belief that real estate investment should be accessible and profitable for a wider range of investors. We saw the potential in well-managed apartment communities to generate consistent income and long-term wealth. Our team brings together experience in real estate acquisition, finance, property management, and investor relations.

JENNIFER CRAIG

HR

Jennifer ensures the company attracts, develops, and retains top talent. She fosters a compliant, healthy, and productive work environment while managing employee relations, onboarding, payroll, performance reviews, and company culture.

PAUL ROBERTS

INSPECTION OFFICER 1

Paul conducts detailed inspections of properties before and after acquisition, renovation, or resale. He assesses structural integrity, regulatory compliance, and provides photographic evidence and written reports for investor and internal review.

HELEN MARLA

INSPECTION OFFICER 2

Helen works in tandem with Paul or independently to inspect investment properties. She ensures each property meets safety and profitability standards before purchase and documents any needed repairs or violations.

SMITH ROBINSON

TEAM LEGAL ADVISOR

Smith advises the company on all legal matters including contracts, property acquisition, zoning laws, litigation, and investor protection. He works closely with external counsel when needed and ensures the company operates within all state and federal regulations.

Frequently Asked Questions

What are the most frequent questions asked about investing in

apartment buildings by accredited investors.

Is investing in apartment buildings a good idea?

Yes, apartment buildings can provide steady cash flow, appreciation, and tax benefits. Unlike single-family homes, they generate income from multiple units, reducing risk.

What are the different ways to invest in apartment buildings?

Investors can buy an apartment building outright, invest through crowdfunding platforms, join real estate investment trusts (REITs), or partner with other investors.

How do I become an accredited investor for apartment building investments?

Accredited investors must meet income or net worth requirements set by the SEC. This typically means earning at least $200,000 annually ($300,000 for joint income) or having a net worth exceeding $1 million, excluding primary residence.

What financing options are available for apartment building investments?

Investors can use traditional bank loans, government-backed loans, private lenders, or syndication deals to finance their purchases.

What are the risks involved in apartment building investments?

Risks include market fluctuations, tenant vacancies, property management challenges, and unexpected maintenance costs. Proper due diligence and management can mitigate these risks.

How do apartment buildings appreciate in value?

The value of an apartment building is tied to its rental income. Investors can increase property value by improving amenities, raising rents, and maintaining high occupancy rates.

What tax benefits come with apartment building investments?

Investors can benefit from depreciation deductions, mortgage interest deductions, and potential tax advantages through 1031 exchanges.